Project Summary

InstantSuretyBond.com is a digital platform designed to simplify and accelerate the process of obtaining surety bonds, which has traditionally been complex, paperwork-heavy, and time-consuming. The goal was to transform a legacy financial service into a clear, fast, and self-service online journey, allowing users to find, apply for, and receive bonds in minutes rather than days.

This project focused on reducing friction, building trust, and guiding non-expert users through a high-stakes, compliance-driven workflow.

My Role

Product Designer / UX Strategist

Responsibilities included:

• UX strategy and end-to-end experience design

• User journey mapping and workflow optimization

• Information architecture and content clarity

• Interaction design for complex, regulated flows

• Collaboration with product, engineering, and business stakeholders

The Problem

Surety bonds are required for many professions and contracts, yet most users:

• Don’t understand what a surety bond is

• Are under time pressure due to licensing or compliance deadlines

• Feel anxious about making mistakes in a regulated process

• Face slow, manual, broker-driven workflows

Key challenges:

• Complex terminology unfamiliar to first-time users

• High abandonment risk due to confusion or lack of trust

• A need to balance speed with legal accuracy and compliance

Goals & Success Criteria

Business Goals

• Reduce time-to-bond issuance

• Increase completed applications

• Support high-volume, self-service transactions

User Goals

• Quickly identify the correct bond

• Understand what’s required without industry knowledge

• Feel confident submitting information and payment online

Success Metrics

• Reduced drop-off during application flow

• Faster completion times

• Increased conversion from “Find a Bond” to purchase

User Research & Insights

Through workflow analysis and stakeholder interviews, key insights emerged:

• Users don’t start with bond knowledge: they start with a requirement (“I need this bond to get licensed”).

• Clarity beats persuasion: users need straightforward explanations, not sales language.

• Trust signals are critical: users are sharing sensitive business and payment information.

• Speed matters most at moments of stress, especially for last-minute compliance needs.

Design Approach

1. Clarify Before You Convert

The experience was structured to:

• Help users identify the correct bond type quickly

• Explain requirements in plain language

• Reduce cognitive load at each step

Information architecture was simplified into a clear progression:

Find your bond → Apply → Review → Purchase → Receive

Find your bond → Apply → Review → Purchase → Receive

2. Design for Confidence in a Regulated Experience

Because this is a financial and legal product, the design emphasized:

• Clear labels and instructions

• Predictable steps with visible progress

• Reassurance through consistent language and layout

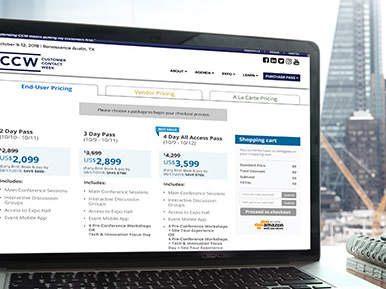

• Transparent pricing and expectations

Trust was reinforced through:

• Educational content embedded at decision points

• Reduced ambiguity around required information

• Clean, professional visual design

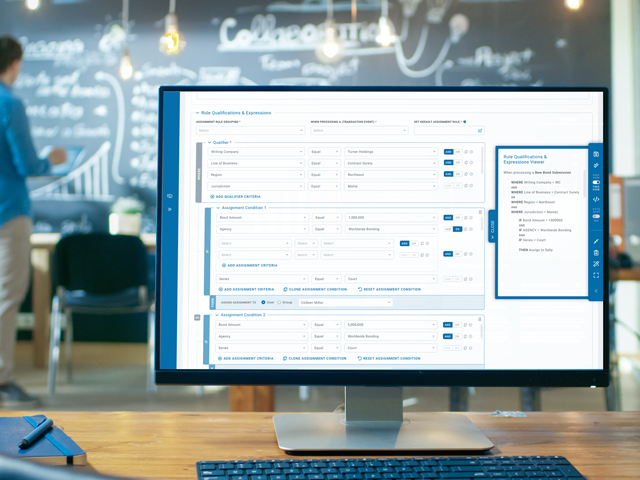

3. Reduce Friction Without Sacrificing Accuracy

The application flow was optimized to:

• Minimize unnecessary questions

• Group related inputs logically

• Prevent errors through validation and guidance

• Allow users to move quickly without feeling rushed

This balance ensured compliance while maintaining a fast, user-friendly experience

Key Design Solutions

• Guided Bond Discovery: Users are helped to identify the correct bond rather than searching blindly.

• Plain-Language Content: Legal and industry terms are explained simply and contextually.

• Streamlined Application Flow: Reduced steps and clearer input requirements.

• Immediate Digital Fulfillment: Bonds are delivered quickly once approved, reinforcing the platform’s value proposition.

Outcome & Impact

While exact metrics are proprietary, the redesigned experience contributed to:

• Faster completion times

• Reduced user confusion and support dependency

• Higher confidence at checkout

• A scalable, repeatable digital workflow for a traditionally manual service

The platform successfully demonstrates how complex financial products can be delivered through a modern, human-centered digital experience.

Key Learnings

• Designing for regulated industries requires clarity, trust, and restraint

• Speed is only valuable when users feel confident and informed

• UX plays a critical role in translating legal requirements into usable experiences

• Removing friction doesn’t mean removing guidance; it means designing it better